If you read the introduction post, you now know that I am now Financially Independent (FI), that is my passive income exceeds my monthly expenses. Now two initial questions might come to mind – the why, and the how.

First, the WHY?

Here’s a little story to underline my “why” – and trust me, you will need a strong one because getting to FI is hard work and requires sacrifices.

The company I currently still work for hired me right out of High School in Germany in 2011, and through them I combined an apprenticeship as an Industrial Mechanic with a Bachelor’s degree in Mechanical Engineering – something called a “Verbundsstudium” (combined studies). Very common in Germany, here in the US not so much. It’s great, because through the program we were paid a salary to learn a trade and we got paid while we were going to university (which was free in Germany – in most places still is, or at least very low cost). It wasn’t much, but a few hundred Euro have or not have each month as a student made a big difference. Of course I was young and stupid, so instead of saving and investing most of it, I blew it on partying, traveling and the standard costs of living after moving out from my parents’. So at the end, even though I did not have a whole lot saved (maybe 5,000 Euro or so total until then*), I graduated debt-free. A pretty big advantage compared to most of the US graduates as I’ve come to known. I finished school and moved to the US in April of 2016, ready to make an impact in the Automotive world. Starting salary: $68k – I was rich.

Like everyone else in my Metro Detroit based team, I was on a non-immigrant visa, which was valid for 5 years with the option to extend. This visa was 100% tied to my company and only for the exact position of Application Engineer I was hired for. I found out the hard way that what this means is that the company had me by the balls. Sure, I was promised a Green Card, but now I think my employer hired incompetent lawyers on purpose to delay it as much as possible (jk, they were probably just the cheapest). So I watched three of my international co-workers all finally get their green cards after their fair share of delays, and them promptly quitting their jobs one after another. All of them severely overworked and underpaid, with a boss who didn’t see (or care to see) any of the many, obvious signs.

What followed was the biggest lesson I learned in my life to date. “Ain’t no way they’re gonna make me do all their work, right!? We’re gonna hire new people, right!? They will pay me loads of money to do all that extra work they’re asking me to take on, right!?” – NOPE. Sure, we “tried” to hire more engineers, and we did for a hot minute, but all of them left after a few months and a nice training period after they saw the shit show they found themselves in. Unfortunately for my company they were not on a Visa like I was, which left me with a workload of what was about 5x that of one of some of our more senior engineers. At the same time I was still winning tons of business for my company through my customer focused engineering support – contracts worth ten’s of millions per year in supplied parts. With all that evidence I turn to my boss and ask for a promotion and raise, fully expecting them to double my salary (seemed fair to me since I was adding much more value than two “regular” engineers, right?). I pitch my boss and of course he agrees (he always agrees).

A month or so later, my VP calls me into his office with “great news”. A promotion was coming… So what did I get?

A 10% raise, with the option for an additional 10% bonus, and the use of a company vehicle**. According to my manager and the VP, both very excited about it, “the biggest raise anyone here has EVER gotten all at once!”.

To me, the equivalent of a giant slap in the face. I wasn’t able to hide my disappointment, nor did I try. They quickly reassured me that “more promotions are in the pipeline, but it takes time”. At a large corporation, everything always takes time, and it became painfully obvious to me over the years that the difference in annual merit increases between a high performer and someone who adds next to zero value, complains all day and getting them to do any work is like pulling teeth, is about 2%. Sure, they made efforts to bump me up outside the usual pay bumps (I got the occasional ~5% raise due to top talent pools), but given the workload it absolutely didn’t cut it in my eyes.

That evening, sometime in October of 2019, marked the beginning of my journey to FI. With me clicking through YouTube, and the algorithm doing its magic – probably sensing my feelings or more likely, listening to me complain about work and wondering how to quit this job (that day a lot more than ever before) – suggesting a video about how to become a millionaire through real estate investing (https://www.youtube.com/watch?v=naZAknwNgkY, thank you Brandon Turner). I learned about this thing called Financial Independence and it quickly became a small obsession of mine.

My goal: To be able to quit this job ASAP and get out of this toxic environment. To be my own boss, to have more than 15 days of vacation, to be paid what I’m worth, to be able to do what I want, when I want, to spend time with my family, to be able to see the world and especially to not slave away the 10 best hours of every weekday for a company who isn’t appreciating their employees enough***.

I also realized whining about my job didn’t get me anywhere, and that I had to hustle if I wanted to achieve FIRE (Financial Independence Retired Early) within a few years. I had a strong why – which brings me to the how.

Second, the HOW?

In theory it’s simple. You need to acquire income producing assets. The income from said assets needs to exceed your monthly expenses and voila – you’re FI and congratulations, within the realms of legality, you can now do with your life whatever you want. Sounds simple, and in its very basic form we only have two knobs to turn to become FI: Income and Expenses.

You can either increase the (active or passive) income your assets produce until it reliably exceeds your expenses or you can reduce your spending. In order to reach FI as fast as possible, I recommend you aggressively work on both levers at the same time, like my wife and I did.

Let’s start with your expenses:

Saving on the occasional Starbucks coffee won’t tip the scales much. We need to tackle your largest expenses first, including, but not limited to:

- Housing

- Transportation

- Groceries

- Utilities

- Insurance

- Shopping

- Entertainment (incl. eating out)

- Debt Services

- (Taxes) – more about that in a later article

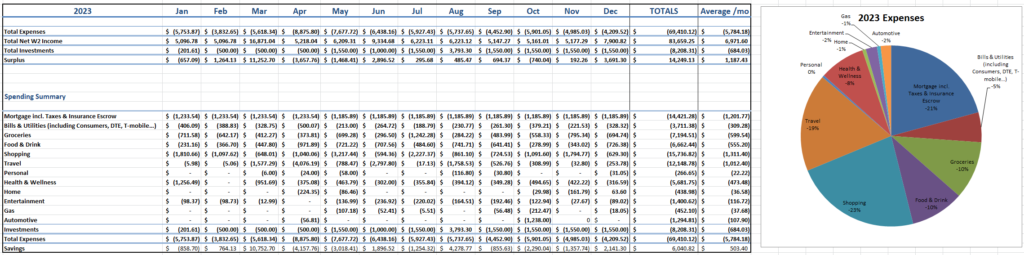

If you haven’t got it already, you need a clear picture with no excuses of where your money goes each month. I recommend spending a few hours to consolidate your bank statements as far as they go back (should easily be two years) and categorize your spending. A lot of banking apps do it automatically, but I like to download the statements and consolidate them in Excel on a per month basis into categories, and then summarize them on “yearly totals” sheets for my private accounts as well as my business (like I did here for 2023, and yes sometimes this is my idea of fun):

This also allowed me to show my wife that we spent too much money on shopping and travel last year, and that we’re only FI if we cut down on that by a good 30k or so. Easy-peasy, though, because we had an international wedding to pay for so it was an extraordinary year for us.

Whatever you see in your own income/expense summary will give you a good idea what your FI number would be if you did not change your spending habits. For us in 2023: $70k/yr or $5,800/mo. Good to know, but under normal circumstances a spending level of $50k/yr should easily suffice for us in our current situation. Of course, depending on countless factors your FI number could look very different from ours. For now, take note of it and we’ll come back to it after a small detour into the 4% rule.

The 4% rule (or 4% safe withdrawal rate) is based on a 1998 paper called the Trinity Study, and yes it still holds true today according to updated research. This rule of thumb says that in a mixed portfolio of stocks and bonds (think: mainly index funds), you will very likely not run out of money over a period of 30 years, even when you started investing right before a crash. In fact, during that same period it is much more likely for your portfolio to grow rather than shrink with this 4% safe withdrawal rate. In other words, you will need about 25x the amount of your annual spending invested and you are FI. In my personal example above, since we estimate to need about $50k/yr to live comfortably, we need a nest egg of $1.25M invested mainly into stocks.

It’s possible and as with all investing, time is your friend. For example if you start from nothing, but are able to put $3000 each month aside and invest it at a 7% compounding rate (for example in a low-cost index fund), you’d get there in about 18 years. Living very frugally I could do the $3000/mo, but there was no way I could do this job for 18 more years (which would have put me at 46 for retirement – I was 28 in 2019). I had to get there faster. For me this meant investing more, using leverage and get higher ROI’s.

Enter real estate.

I learned that with real estate, the amount of money you can make only depends on how good of a deal-maker, deal-finder and operator you are, but the ROI’s could theoretically be infinite. All that was left was to convince my wife (which was easy, because she’s great), and off to the races we were. I found myself a good realtor, who happily and patiently entertained working with a first-time buyer like me, who wanted to “find a good deal”. He showed me the ropes and after seeing about 30 houses or so got ourselves an offer accepted on a home in need of a cosmetic rehab. We closed on it in January 2020 and got to work.

The listing photo of our first primary residence.

Buying this home marked the beginning of our real estate investing journey, and after pretty much exactly 4 years, 7 more houses, and EXTREMELY hard DIY work on all of those houses, our long term and short term rental incomes (minus all expenses, Capital Expenditures and buffer for reserves) cover our initially desired spending level of $50k/yr.

Personally, this brings me to an interesting time in my life. Able to quit my job at 32 years old and enjoy life, with an amazing wife by my side and a baby girl on the way, yet trapped by the golden handcuffs of the automotive engineering industry. Meanwhile, I was promoted to the Manager of the eight or so Application Engineers in our team which I helped re-build and I finally got my green card after 7 long years. So while work is as busy as ever and it kills my soul a little on a daily basis, the money also finally caught up to an extent. Of course I still make way less than I feel like I deserve – and that will likely never change for as long as I decide to work for a large corporation. A tough tradeoff between the (perceived) safety of a job vs. the risks, but unlimited opportunities of a fully entrepreneurial life.

So where does this leave us?

Let’s come back to the question at hand, the how. As you can see, reaching FI, even within just a few years, is achievable. There are slow ways and there are fast ways, and nothing is wrong with either path, because the end goal of Financial Freedom is so rewarding. I will write more detailed posts about the how in the upcoming weeks and months. Stay tuned.

My recommendation: take some time and get crystal clear on your why, doing your budget, coming up with your FI number and then start tuning your own Income and Expenses knobs!

Prost and take care,

-Daniel

During our first DIY rehab in January of 2020

Feel free to leave a comment with your own experiences, questions or ideas for later articles!

If you want to reach out to me for some personal coaching or other inquiries, click here.

*my parents taught me from a young age to always save a portion of your paycheck, and NEVER EVER spend more than you make/have. I also delivered TV guides for years, worked at the German post office and took on other odd-jobs in the construction industry since I turned 14 years old during school holidays.

**The vehicle, because each month I was expensing personal vehicle trips of ~$500, at which point it was probably cheaper for the company to get me a car instead of reimbursing me lol.

***For shits and giggles, and in leu of recent events, see below the latest announcement for our employee appreciation day (we are a 25 billion USD annual revenue company):