Alright guys & gals – 4 years ago there was a moment where work pissed me off so much, that I that I looked at my office cubicle and realized this couldn’t be everything life had to offer.

That moment changed everything.

In this blog post I will share with you how that realization led me to financial independence, and how I set myself up for life in just about 4 years.

Quickly once again – what is FI?

Financial independence means that the income from your “passive” investments or businesses or whatever exceeds your monthly expenses. As soon as this cross-over happens, you are financially free and do not need that W2 job anymore and can tell your boss to go pound sand the next time he goes off on you for no reason.

Now, if you can’t think of why this would be a desirable goal, let me give you a hint. Right now you’re probably working (like I was and currently still am) for some kind of employer in some kind of W2 fashion. That company, or employer has you by the balls (or the titties). As soon as the next big layoff season comes around – here in the automotive industry it’s right now, in tech still ongoing – tell me again about that secure job you have.

Maybe you have also realized that high performance at said employer does not necessarily equate to much higher pay, but in most cases it instead results in significantly more work (because you can take it on efficiently, and Alfred over there is old and frail and grumpy, and likes to have water cooler conversations all day and it’s too much of a pain to get him to do any work, so we don’t even try anymore). But oops, during merit increase season your difference in performance leads to the same raise within a couple of percent, all while you’re making 80k and he’s bringing home 120k. Yep maybe you have a story like that as well.

So, since we’ve established that corporations really don’t care about the single employee, I think that it should be all of our #1 priority to buy back our time and to reclaim freedom for ourselves and our families, because life isn’t meant to be spent in a cubicle for 9h after sitting in traffic twice a day.

And this is why I want to teach you all I can about FI, or FIRE, because it’s the most worthwhile journey I’ve ever been on in my life.

My Pre-FI Life & Realization

I grew up in Germany and was taught a good bit about how to be a good employee, how to fit in, be punctual, be precise, but most importantly, nothing about personal finance. And from what I have seen, that part is much worse here in the US. At least a fair amount of Germans are savers, and saving (but DEFINITELY NOT investing) is seen as noble.

I finished a combination degree – apprenticeship industrial mechanic and bachelors of engineering – and moved to the US in 2016 to start my first real engineering job in the automotive industry under a non-immigrant visa. My starting salary then: $64k – I was RICH!

If you’re rich like me, you do what any bachelor in their 20s would do, you blow it all on rent, a car and partying on weekends.

Luckily, due to my frugal upbringing and German-ness, I did all of that in somewhat moderation, and rented a place with a roommate (still expensive), bought a used car for cash, and tried to pre-game a lot to keep the party spending low, which led me to always have a half-decent savings rate (I’m guessing around 30% on average).

Fast forward a few years, work gets worse due to varying reasons, all my fellow immigrant teammates (a Brazilian, a Slovak & another German) get their green cards and literally all quit one after another within a year because we were all severely overworked and underpaid. Side note: the next two engineers we onboarded and trained in the next couple of years also left within ~1 year every time. As you can probably guess, they were not bound to my company through a visa…

So I find myself working a job with the equivalent value add of about 4-5 average engineers, while still winning tens of millions of dollars in parts contracts for my company and no major promotion in sight, just a ~5% merit increase here and there.

I was burning out at a ridiculously fast rate. During peak times I was receiving roughly 200 e-mails per day, and had 7-8h of meetings at the same time. It was absolutely nuts.

I finally ask my boss for a raise and they agreed to give me the biggest raise this company has ever seen all at once for an engineer, according to them: Turned out it was a 10% salary increase, option for a 10% bonus, and use of a company vehicle!

Yep, I was doing the work of about 5 Alfreds and my reward for almost killing myself for this company on the daily was about a 25% salary increase. Note that AFTER this BIGGEST PROMOTION EVER my pre-tax income was $82k/yr.

That was the turning point for me and the realization that a company will NEVER EVER pay you what you’re worth. And in my case, since I was on a visa, they really had me by the balls. If I wanted to leave, I had to return to Germany – and of course they knew that – which why I think they slowed down my green card on purpose. The entire immigration process ended up taking me from March 2017 until March 2023 – 6 years and 3 tries with 3 different, employer sponsored law firms. Note that my colleagues who quit, received their Green Cards in about 2-3 years, which was about normal for a case like mine.

Long story short – that “promotion” was the beginning of the end as a W2 employee for me, because that night I googled “how to quit your shitty job early” and I finally discovered the concept of FIRE – Financial Independence, Retired Early.

Fast forward 4 years, about 100 real estate investing, finance, entrepreneurship, leadership, personal development and so on books later, working most afternoons, nights & weekends and my nutty W2 day job, my wife and I got there – but how and is it worth it?

The Basics

First I want to plug an excellent blog post by a FIRE guru I discovered shortly after my realization – Mr. Money Mustache’s Getting Rich: From Zero to Hero in One Blog Post. Because in essence all this FI stuff is pretty easy and can be summarized quickly. I recommend you read it because it really is excellent and he knows what he’s talking about.

For the lazy ones amongst us (that usually includes me), here’s the key message:

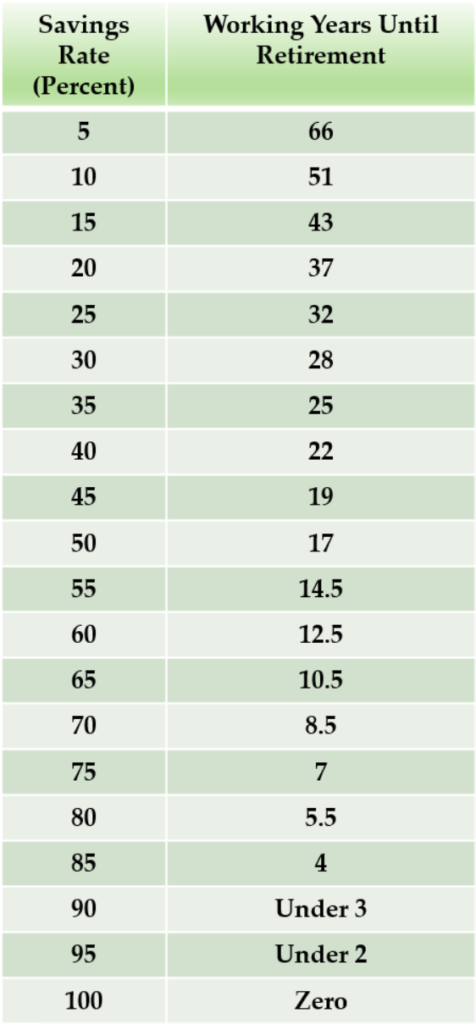

To be honest, my mind was a little blown and I had to do some math to verify, but I can confirm it checks out. Here’s a link to one of many calculators for you to play with the numbers yourself.

So to summarize, in essence it is easy, you need to reduce expenses as much as possible, and then you can retire early – OR – increase your income as much as possible, while keeping your expenses low (thus also increasing your savings rate).

Now how the heck do we do that…

The Steps

I’ll probably write a longer blog post about it in the future, but first off, you need to get the best possible, no nonsense picture of your financial situation. That means you need to know exactly how much money comes in and what exactly it’s spent on month after month. I absolutely cannot believe the amount of Americans that cannot come up with a $1,000 emergency expense (apparently 44% of you). If you, my dear reader, are one of them – you will need to change this fast.

Here’s how: Today you will research the best budgeting apps out there (I did the googling for a Nerdwallet article about this topic for you here), or build your own spreadsheet in Excel. This is what I did because I like the autonomy – and once I built it, it takes me less than 5 minutes to do my monthly budgeting, plus I can put all kinds of fancy KPIs and metrics and graphs in there. Reach out to me via the contact page if you want a copy and I’ll send it to you. Then you will consolidate everything and get a no nonsense picture of your income and expenses for at least the last year. Your bank probably keeps statements for at least the last three years if you want to get an even better picture (and I recommend it).

Then let the numbers speak. Where do you fall in terms of monthly savings rate and are you on track to retire anytime soon?

Note that this does not take any prior savings, social security or your own 401k, or whatsoever into account. The message is pretty powerful. If you only manage to save 10% of your income, which is above average, since the national personal savings rate is sitting at ~4% – Congratulations! You are on track to work for 51 years.

Of course I hope that Social Security pays up in the end, but who really knows what will happen 30 years from now and what will happen to it at the rate our government is spending tax dollars, but for the record, I don’t think we should rely on the government to take care of us financially in the long run, and if we do receive anything in the future, I see it as the cherry on top, nothing more. The point I want to make here is that we absolutely need to take our retirement into our own hands, and if you truly want to buy back your freedom before you turn 67, you have no choice but to crank up your savings rate significantly.

And the effects, like Mr. Money Mustache wrote before, are surprising: If you manage to live on 50% of your disposable income and you are on track to retire in less than 17 years. Crank it up to 75%, and your working career is only 7 years!

That means, if you are serious about early retirement you will likely have to ruthlessly cut spending AND increase your income at the same time.

Here’s how we did it

Our starting point in late 2019 was the following:

- My savings rate the prior years was about 30% like I mentioned before, so I had NO DEBT whatsoever

- I had roughly $30,000 in savings and post-tax investments

- I had a 401k with about $40,000 in it (my employer matched 6%, so I always contributed that at a minimum)

- I had the ultimate drive to not work this soul sucking job a single minute longer than I had to

- The first book I picked up after I learned about FI was “Rich Dad Poor Dad” by Robert Kiyosaki (HIGHLY RECOMMEND, LITERALLY CHANGED MY LIFE)

The goal: to significantly decrease my expenses while getting started on investing and to increase my income through rental properties. This meant the unfortunate end to my time as a bachelor, renting our fun place in a fun (but expensive) town with my fellow German engineering roommate.

After filtering through hundreds of homes on the MLS, looking at tens of them, we sort of found a deal. It’s been sitting for a while, and was occupied by a very dirty family who needed the proceeds of this sale to close on their other house. They dropped the price a few times and were getting desperate, so we bought it for $120k (with 20% down + mortgage) after a few concessions were made.

The area: juuuuuust okay. A slowly up and coming suburb but close to 8 Mile Detroit (where Eminem is from). Gunshots from the Detroit hood were heard on a semi-regular basis, and we saw the occasional naked man and druggie walk down the road.

The scope: a little bit of everything (deep clean, patching, painting, tiling, glazing, staining and so on). Just enough to make it interesting.

We learned a ton in the process (thank you YouTube), made it look real nice on a very tight budget of ~$5,000 and lots of sweat equity, and were able to refinance our loan 6 months later with a new appraised price of $155k @ 3.5% interest rate with a 30 year amortization. This meant we got our entire down payment back after just six months, AND my monthly loan payment was only $550. Including escrow (city taxes + home insurance) we paid about $850/mo, which my wife and I split from there on.

First mission accomplished: We reduced our payments and started to build wealth.

Now to rinse and repeat.

We continued to look for deals that needed work, fixed them up by ourselves on a tight budget, cash out refinanced after the repairs and updates, rented them out, and did this again and again. A strategy called BRRRR (Buy, Rent, Rehab, Refinance, Repeat) if you want to read more about it. By the way, I realize that this is harder nowadays with higher interest rates, but if done right can still yield great results if done correctly. I only have the one property with a 3.5% interest rate, the others are in the 4s, 5s, and now even 7s…

Every day after work we went back to “work”, renovated, and most weekends we did the same.

Below photo dump is from the first one, but we did it in similar fashion for all 8 of our houses (to date). Each house we learned more and got a little better.

And there you have it – there really is no secret but very hard and consistent work, discipline and always living below your means.

Over the course of the last 4 years we kept our spending level as low as possible, while at the same time never feeling deprived of anything because we had the long term goal of FI in mind with every decision we made. I continued to work hard for my W2 job as well, so while I felt underpaid the entire time (and still do), I managed to get 1-2 raises per year. Now I manage a team of 7 engineers and I try my best to make work for them as fair as possible, and not to repeat the same mistakes my boss made since I’ve known him (unfortunately yes, he’s still is my boss, and yes, he’s still the worst leader I have met).

In terms of financials, our W2 savings rate alone has been hovering at around 40-50%, but with the additional income (after all expenses and reserves) from all our long term and short term rentals we are at a savings rate of well over 100% each month. On top of that we have additional stock investments, a 401k, a Roth IRA, HSA and a high yield savings account (Discover paying 4.25% APY as of time of writing this) that could cover our expenses over multiple years.

Now back to you

Like I mentioned a few times before, now is the time to get crystal clear on your own financial situation. If you have debts, especially high interest debt (anything greater than 8%), it is time to tackle those fast. I recommend taking care of your highest interest debts first (especially credit cards!), and then working backwards from there. If you are living like a king, make decent money but don’t manage to save more than 10% each month it is also high time for a change and really crank up that savings rate.

Take a real good look at your liabilities and payments each month and see if you can downsize. This includes of course the usually highest expenses per month: housing and cars. Look into house-hacking and lose that expensive leased car for a reliable used one that gets good gas mileage. Look at your food budget and find more economical ways to keep everyone fed – note that eating out is not one of them! Nothing beats the cost (and health benefits) of cooking your own meals at home after shopping at Aldi or Costco. And monthly subscriptions like Netflix and co. don’t just cost you money, they also cost you something much more important: your time which you could utilize to get educated on investing.

Once you are in a position of financial strength – meaning no high interest debt and a decent savings rate as well as a financial cushion (think emergency savings), then it is time to invest into more aggressive vehicles for future growth, like real estate and entrepreneurship.

So reclaim control of your financial situation and your life, your future self will thank you for the short term sacrifices you make now.

Good luck!

Prost,

-Daniel