Alright folks, if you’ve been following and you figured out your why and you read the post on how I achieved FI in 4 years, it’s time to create your own action plan. While this is likely a multi-year plan, this should give you a good overview and actionable steps of what it will take to achieve Financial Independence yourself.

Step 1: Understand Your Finances

I discussed the 4% rule before, but we’ll do it again in one sentence because it’s important:

The 4% rule is a rule of thumb guideline suggesting that you can withdraw 4% of your retirement savings each year to cover your living expenses without depleting your funds over a long period of time (30+ years). You can read more here for an updated version, suggesting it is still very applicable today.

So every dollar we want to spend in retirement, we need to have invested 25x over (1/0.04=25).

Meaning: if you want to have a post-retirement spending level of $40,000 per year – you’ll need $1,000,000 invested in a largely stock heavy index fund portfolio –> $1,000,000 x 4% = $40,000.

Those $40k/yr roughly equate $110 per day. Not a whole lot but bare with me. If you manage to cut just $20 per day – you will be able to retire with close to $200,000 less than what you needed before ($90 x 365 days x 1/0.04 = $821,250 needed invested).

Once again the point is that every dollar not spent gets amplified with a very large 25x lever when it comes to retirement. On top of that a higher savings rate allows you to invest more and feel the effects of compound interest work in your favor sooner! And if you need another reason to spend less – you are spending post tax dollars for which you pay extra sales tax when you buy anything, so depending on your marginal tax bracket you need to earn between $25-30 to spend just the $20.

One last point. The psychological difference in your spending level and perceived retirement needs are not to be underestimated either. The difference in investments needed between a $40k annual post-retirement spending level and an $80k one is a full million dollars – very significant.

Don’t get me wrong – I am all for a lavish lifestyle in retirement and I might want to get there one day too, but early on, especially during our younger years and to set a solid foundation, bootstrapping hard and living the frugal life is super important.

Further, once the initial compound interest ball gets rolling and you are actually able to buy back some of your freedom, you will be able to spend a lot more time on pursuing entrepreneurship which is the key to true wealth and a lavish retirement. As a simple employee, you will most likely never get there. So live a decade or so poor like none of your peers, to spend the remainder of your life living rich like none of your peers.

And finally, this is where a budget comes in. You need to understand and track where every dollar goes to set the right foundation for your early retirement journey.

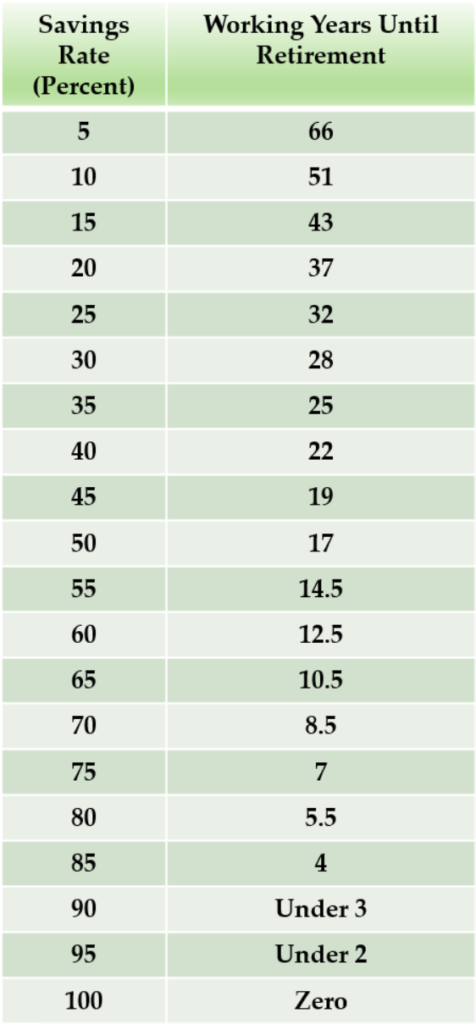

I like to play with excel sheets and I built an easy one for myself so I can track every single dollar once per month by spending about 5mins on downloading statements and copy/pasting the data over to excel – done. Reach out to me if you want the template, but otherwise get a budgeting app and do the same thing. Really look at every months’ income and expenses and the resulting surplus (or deficit?). Where is your average savings rate sitting? Are you on track to retire in 10, 20, 30, 50 years or never?

Then factor in your current assets and liabilities – with a big focus on your liabilities. I hope I don’t need to tell you this, but especially if you have high interest debt like credit cards (consider anything greater than 10% interest for now), double down and do anything to pay it down fast.

Second priority debts would be ranging from 5%-10% interest rates, since arguably this is roughly where inflation stands these days… Anything lower than that you can likely keep for the long haul if it doesn’t bother you. Personally, my only debts are 30-year mortgages with interest rates in the 3s, 4s, 5s, and one in the 7s (which I may tackle at some point). But most of these are through my LLC so at least the interest part is a tax write-off which makes it a little less bad.

Either way, now it is up to you to get a good grasp of your financial picture. The most important is to take action, and to try to optimize your savings rate – which brings me to:

Step 2: Cut Unnecessary Expenses

Here is where you look at your newly derived, beautiful budgeting spreadsheet or app output. And maybe your eyes will widen after the realization that you spent 30k in the “shopping” category last year, or 20k at eating out, or 15k in car payments. Or that your savings rate is a whooping 3.6% (which is the national average), thus enabling you to retire basically never.

Whatever it is, it’s probably high time to increase that good ol’ savings rate to something in the 30% or 40% if you can, to start acquiring a nice financial buffer and pay off debt. In order to do this we should look at all of our expenses. This especially includes housing, transportation, and food, since they are usually the largest expenses on that list and naturally can have the biggest impact. Especially if you are in your 20s and 30s, now is the time to live like a poor person and work as hard as you can.

Once I learned about FI, my wife and I bought a cheap house in a (barely) up and coming area, which was in need of a VERY good cleaning and many updates. Therefore we got it below market value and went to work. As a result we dropped our previous rent payment of $1,250/mo (paid for by myself, shared with my old roommate) to a total mortgage of $800 which we then shared between the two of us. So with one move I dropped my housing payment by $850/mo – all of which went towards upping that savings rate and later on into other investments.

Since housing is usually the highest monthly post-tax expense, I suggest you consider “house-hacking“, where you buy a house and rent out all other bedrooms to friends or put them on Airbnb. This also works well with a duplex, triplex or quadplex if you don’t want strangers in your home. You will build equity while possibly dropping your largest payment category each month to zero, or at least very significantly.

If you drive an expensive car, it’s probably time to sell it and switch it out for a reliable used one. Especially if you are leasing a new one every 2-3 years you are likely throwing out tons of money out the window.

And if you go out to eat multiple times a week it’s time to embrace the art of home cooked meals for a healthier and much cheaper lifestyle. If you like going out to bars, make a point to arrive there after a decent amount of pre-gaming and limit yourself to one or two beers, and then water for the rest of the night. Your body the next day will also thank you.

Whatever it is, I recommend to look at all expenses and run the math. See what your savings rate could be if you cut your expenses and what that would do to your retirement plan. Then reevaluate if spending that kind of money is worth delaying your retirement by decades, potentially?

Of course nobody wants to live like a poor person forever, and I promise you won’t have to – which brings me to the next step.

Step 3: Increase Your Income

Therefore, we have to put ourselves in the best position possible to get promoted fast. How do we do that? Glad you asked.

You will work as hard as possible during your scheduled work hours and BE VISIBLE TO YOUR MANAGEMENT. In essence, every company exists to make money, so you will do your best to help achieve efficiencies, or make your company/department money in other ways.

- You ask for more responsibilities, and do your work diligently, fast, nicely and exceed expectations of your boss(es) in every way – and make sure they see that.

- You ask your boss what his expectations are exactly, how you can exceed them, and what your career trajectory should look like. Then you follow up on a quarterly basis and update him/her on all your achievements and how it helps them with their department goals

And then you talk about money. Once you made yourself an essential resource in your bosses mind, they will not want to hire and train a new employee if you are “a risk of flight” – that is, at risk of maybe changing to the competition.

This is where you have real leverage and should start serious negotiations. To be equipped with all the tools, I recommend you read: “Never split the difference: Negotiating As If Your Life Depended On It” – by Chris Voss, a former hostage negotiator. Not only educational but also highly entertaining!

If your current company is not flexible enough, now is also the time to change jobs and look for the greener grass on the other side. Once you actually have another offer on the table (should be at least 20% higher than your current job), your current company might also counter and start a small bidding war. This actually happened to one of my peers, who received an offer from the competition. He brought it to my leadership’s attention and was able to bump his salary from 82k/yr to 120k/yr within a two-week timeframe! He is one of those engineers who does great work, but historically never asked for anything and therefore has been notoriously underpaid.

In parallel, it’s time to find yourself a high value side hustle – ideally something you can imagine yourself doing for the long haul and even start a company from it. After all you’ll want to have something to do once you achieve FI. I mentioned in my prior blog posts that for my wife and I this meant real estate. We bought homes in need of repair severely under market value, fixed them up (mainly by ourselves to preserve cash), rented them out for passive income, and refinanced them one after another. If interested you can read a little more about it in my blog post here.

For other ideas and more importantly, how to monetize them into profitable businesses I recommend you read Noah Kagan’s “Million Dollar Weekend: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 Hours“. I recently read that book and wished I had it earlier.

But while you are getting your personal books into order, you also need to know what makes a good investment, and what you should take advantage of, so we move on to step 4:

Step 4: Start Investing Wisely

All that newly found discretionary income needs to be invested in order to grow and work for you in the future. I outline 5 steps which can be done in order, or combined as needed. What is important is that you think about them and then decide on the best strategy for your own personal situation.

1. If your company offers a 401k match – I recommend you (at least) take it up to the percentage of match.* It’s literally free money, and if you don’t agree with the whole “waiting until you get to withdraw it in retirement” you can at least take a loan here and there against your own 401k (only up to $50k) to fuel other investments, and pay yourself (not the bank) back with interest. I have bought a few houses and financed down payments & repairs with a 401k loan here and there.

2. You should fund an after-tax Roth IRA (and put it into broad investments, like VTSAX). You can always withdraw the principal you contributed tax-free (since it was already taxed) and the retirement benefits of post-tax compounded money are huge. There are also options to invest that cash into real estate and other ventures. This is how Peter Thiel turned his Roth RIA into a $5B asset.

3. I recommend you have emergency savings of about 3-6 months of expenses in a high-yield savings account (in 2024 roughly paying ~4-5% APR) to weather any storms without taking on high-interest debt like personal loans or credit cards. This financial cushion can also act as FU-Money, should you finally have enough of your employers shenanigans and keep you afloat until you find another opportunity or get your own business off the ground.

4. Take advantage of pre-tax contributions to an HSA (Health Savings Account). If you have a high deductible healthcare plan, they usually come with the option of contributing pre-tax money into an HSA. That money can then be invested into mutual funds as well, for tax free growth, and tax free deductions for healthcare expenses. As a bonus – after age 65 the money from your HSA acts like an additional 401k account and can be withdrawn penalty free in similar fashion (you’ll have to pay income tax, however).

5. Then you’ll need to think about what to do with the rest of your discretionary income. Once again I don’t recommend blowing it on the latest gadget, but to invest the rest into assets that align with your long term plan. This can range from boring (but proven) long-term investments into low-cost index funds, to real estate, or starting your own business. The cash you are saving and investing from steps 1-4 can also come in handy here, giving you options like emergency withdrawals or additional startup capital from those sources IF you see the right opportunity for big profits (like an amazing real estate deal or business opportunity).

One additional note about real estate investing. While this has become much harder in 2024 due to an environment of high interest rates and high prices, buying cheap is not always the best way to do it. In fact, buying homes in the cheapest areas usually comes with many headaches, like cheap build quality and a bad tenant pool. A lesson my wife and I learned the hard way, but more about that another time. Generally I recommend you try to aim for the ugliest house in the nicest neighborhood, and be prepared to put a lot of sweat equity into the home. The age old rule of the three most important criteria of buying real estate remains true to this day: location, location, location…

Step 5: Stay Consistent and Motivated

Lastly, remember that achieving financial independence will usually not happen in a matter of months or even just a few years. Depending on how hard you hustle and your starting situation, you may need a decade or two to get there. Still – that beats not doing anything and working basically forever, at least in my humble opinion. Regardless, it’s a long time to stay motivated and that is why come back to the fact that you need a strong why.

A little bit of philosophy also helps in that category, and for beginners like myself, I can highly recommend Ryan Holiday’s book “The Daily Stoic”. He found a way to merge ancient wisdom into today’s world via bite-sized daily meditations and every time I open that book I learn something new.

Whichever way you do it, try to build long-lasting, good habits around your newly found aspiring FI lifestyle simply because you will need them. Another book recommendation seems appropriate here to help you with that: Atomic Habits by James Clear.

If you have a husband or wife, it’s imperative that he or she is on board with you buying back your freedom in the long run. You will have to make sacrifices and it is SO much easier if you can do it as a team or within a community. If you don’t have that community in within your friends or family circles (which would be unlikely), you can find them online. Join FIRE groups on Facebook or follow online forums or listen to podcasts about these topics. Remember that you are likely the average of the 5 people you spend the most time with, and if you can’t do it in person (yet), consistently immersing yourself with online FIRE content will influence your thoughts and actions in the long run.

Lastly, if you think you need more help, you can always reach out to me for personalized coaching. We will generate your own personal roadmap to FI and set you up for life in no time. If that sounds interesting – click here. Good luck!

-Daniel

*I have, on average, contributed a bit more than the minimum match of 6% to my 401k, so it is quite inflated compared to my after-tax stock investments. I always liked the instant tax savings, but after reaching FI my mindset on this has changed a little. Unless I use my 401k as a loan (sadly only up to $50k), or pay an early withdrawal penalty, this money is pretty locked away until I reach at least 55 years old. You also have to take into account that at a younger age you may find yourself in a lower tax bracket than when you are 50, so paying taxes on that money early might make sense. Personally, I now believe I will make much more money at 55 than I make now. Either way, having money invested is never bad, so just personal preference!